Due Dilligence frequently focus too heavily on the financials while ignoring the other critically important information required to make a sound decision.

In the past 20 years, I have had the opportunity to work on the development of a number of joint ventures. The question that you frequently ask is;

"Why are some Joint Ventures more successful than others?"

While every joint venture starts with the best of intentions, like marriage, unfortunately many end in destructive divorce. The main reason I have observed for the failures is an unrealistic set of assumptions at the outset which are not discussed between the two or more parties.

A few tough questions can help you and your organizations develop a series of successful JVs.

- Do we really both want to be in a Joint Venture? All too often one party is thinking only in the short term as to the outcomes of a JV. The questions to focus around include "What will this JV look like in 20 years? 50?"

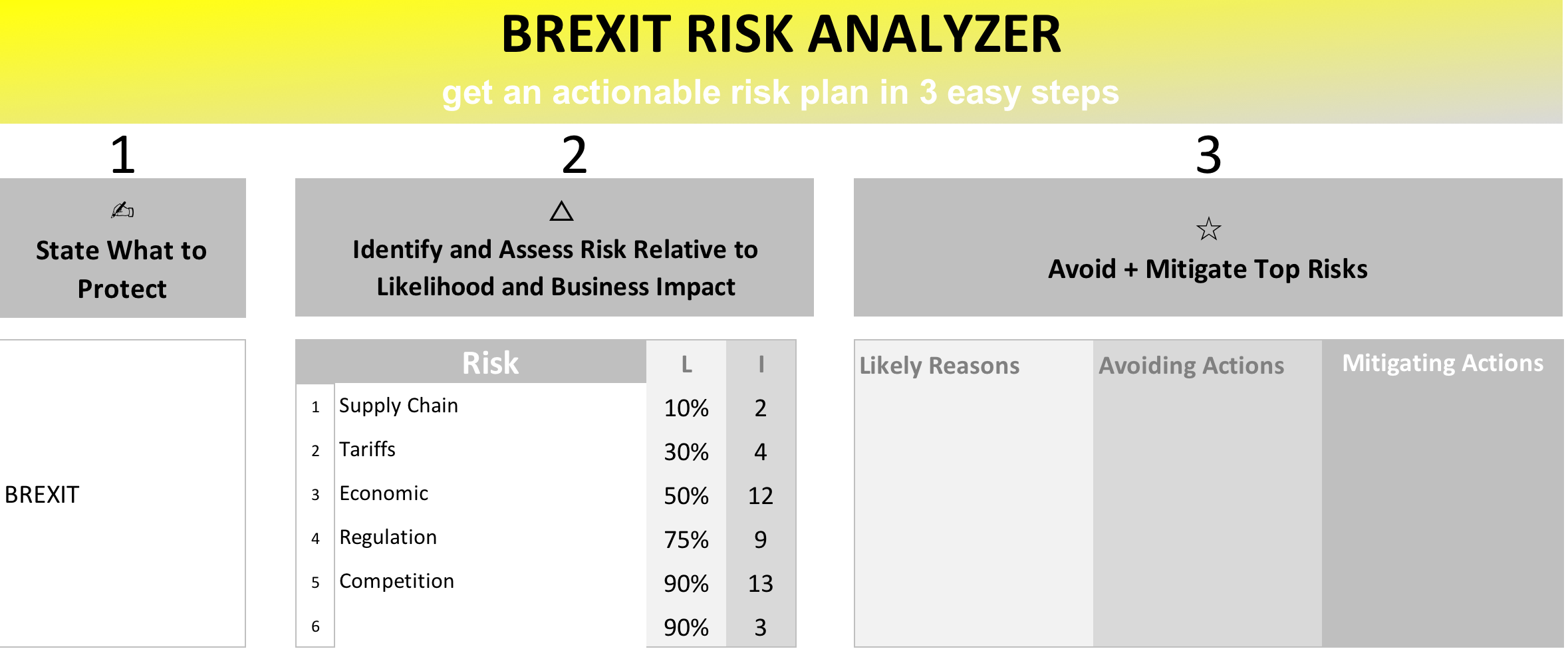

- What are our assumptions about how the markets the JV operates in will develop? Clearly stated strategic assumptions and impacts on the JV of those assumptions will assist both you and the other parties in determining if this is really a good and solid plan. What will currency impacts deliver to the JV? Government regulations? What events could cause the JV to become difficult to manage? The clearer the assumptions are and the closer both parties are in agreement about the impact the more likely it is your JV will succeed.

- Who is running the JV day to day? Which decisions will be taken by whom? While almost all JVs have spelled out in their legal agreement who appoints the General Manager, the CFO, and other key executives, it is not clear frequently about who will be making the day-to-day decisions. Commercially how will the JV price? Marketing-wise which positioning will the JV use? What happens if a competitor enters the market? What if your JV partner is that competitor? Time spent developing the implementation plans and clearly spelling out jointly who will do what and by when is invaluable in the dividends it will pay later on.

While a Joint Venture can certainly be the best way to enter a new market or product offering, it is important to not let this enthusiasm overflow into the development of the agreement together and rather to carefully use a structured process to complete necessary due diligence to determine who and how the JV will actually work.

Learn more about effective decision making...