Managers or CEOs seeking to improve the way the company makes pricing decisions need to implement changes starting from the way the organization collects, sorts and uses data as an input in selecting the best performing alternatives.

As an example, one of our clients is a leading company that designs, manufactures and installs automated industrial equipment systems principally for the automotive industry.

As you probably know, the selling process for this type of product and service offering can be complex to manage for several reasons including:

- Several stakeholders are involved in the selling process from the client side (i.e. the Production Manager, the Business unit directors etc..)

- The average price for a system is several million dollars, and one system may require a total investment of more than twenty million dollars

- Every sales opportunity has specific characteristics in term of client need and urgency

- Decision making criteria adopted by customers can change in time and depend on the specific situation

- There is a bid or negotiation process per each sales opportunity

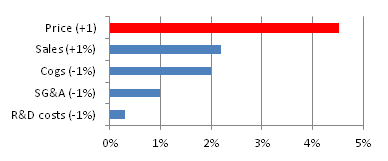

3 years ago, it was clear to the CEO that the decision making process for pricing was a capability that needed to be improved. The main reasons for this were not only the complexity of the selling process but also the impact that pricing decisions have on the company EBITDA.

In the case of this company, the impact on the EBITDA related to an improvement of 1% on the price is almost 5% improvement on total company EBITDA.

igure 1- Pricing Impact Example for a B2B solutions provider

igure 1- Pricing Impact Example for a B2B solutions provider

The CEO understood this impact, and worked to design and implement a better process to support pricing decisions. The initiative started with 2 simple questions:

1- what data do we need to make effective pricing decisions?

2- What data are we actually collecting to make pricing decisions?

If you are also asking these questions, we recommend to focus on 4 areas:

1. Competitive positioning: What is the relative competitive positioning of the proposed solution compared to the main competitors?

2. Customer need: What is the real customer need? What is the relative level of urgency and importance? Why is the customer buying?

3. Investment level for the client: What is the total cost of ownership of the system or solution provided compared to the total product costs?

4. Customer sensitivity: at what extent is the system we provide critical for the overall performances of the manufacturing process?

Concurrently to answering the four questions, complete an assessment that to understand what percentage of the required data to make a decision is being collected by the sales force. In our experiences, typically >20 % of the required data has been collected or used by the sales force for decision making.

This initial phase will have a duration of a few weeks and the implementation of the new way to make decisions involving >10 divisional or business unit managers in different functions (not only sales) normally has a duration of 8-10 months. There is a significant amount of work and leadership involved- the payoff for an initiative of this type has demonstrated to grow EBITDA by as much as 20 % (CAGR).