One of the areas of business which rarely gets much press coverage is “Failed Mergers”. The time and effort spent however on discussions and negotiations which then do not lead to a partnership, joint venture, or outright acquisition consume considerable resources of the Firm. Why do the negotiations break down?

A frequent reason for the failure in the negotation stage is that Strategic Assumptions were not clearly communicated- that is, made visible, early in the discussion stage of the process. The way a company looks toward the future determines who the potential “right” partner will be- as every organization does not see Assumptions in the same way, we recommend the following:

1) Communicate clearly the 4 or 5 (not more) Strategic assumptions which will have the biggest impact on the industry and the company.

2) Share the assumptions with the potential partner, and agree on a combined list (if you want to know how to generate Strategic Assumptions, please read the excellent blog post of May 2nd from my colleague Tim Lewko).

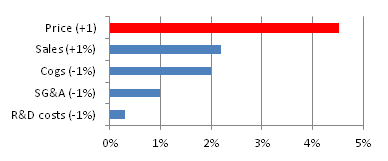

3) Jointly with your acquistion teams- review and agree on the financial impact the assumptions will have on the “New” merged company. This is the time to be blunt and honest- not over optomistic or enthusiastic- realistic.

4) Compare the financial impact to the budgeted synergies- what is the new outcome?

5) Review the updated business case and decide if there is still a valid logic to the acquisition, merger, or partnership.

The entire process will take a maximum of one working day- and the value received provides an immediate ROI- there is no need to proceed if the business case is no longer valid. A number of companies have also- unfortunately- decided to proceed with their M&A plans even after realizing the synergies would not create the initial projected return. The question is why a company would do that- the root cause typically due to thinking along the lines of “we have already come this far in the process and cannot stop now or the market will punish us”. This easy first step serves as a protection against such thinking.