Parity – the state or condition of being equal never turns out well when used in a strategic context. As we stated earlier pricing is a tool that is used to convey relative value to customers. Products that are viewed as equal by customers – whether its perceived or real – become commodities and inherently demand a different strategy to maximize margins – through a low cost model approach. In this strategic case you are competiting on price and price as the only negotiable used always goes in one direction – down. Conversely, if your products or services can be differentiated and offer unique value – the premium associated with it will be larger and therefore offer a better picture of profitabilty. Simple concept – however, we often observe that companies have not examined the historical trends of their pricing (i.e margins beyond Gross Profit) to determine if in fact they are in a truly differentiated and sustainable business or one that is commoditizing. Despite their company’s internal mantra on how they are “much better than the competition” they are continually losing volume and business based on price – or put a softer way as told to the company sales reps – “we have to go with a dual source supplier”.

Much of this issue - no clear margin premium between the commodity and differiated products is the fault of the company itself. For years it has made do with a singular price list – driven from COST PLUS pricing that does not take into account the unique needs and perceived value tradeoffs that customer want to make. The one size fits all price list that rolls off the presses at the start of the calendar year and with blessing of the accounting department ( relying on some type of antiquated allocation done 10 years earlier when the business was 200 people smaller and 2 locations less) continues to be used.

To begin to get a proactive handle on your pricing strategy- you need to initiate the following analytics

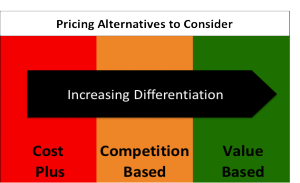

1. Identify the type of Pricing Strategy you are Using ( see illustration below)

2. Analyze the Operating margin magnitude and trend on Products over a 3 year period )There are proxies that can be used to get beyond Gross Profit but still not take a year to figure out)

3. Segment the Products that offer a true premium or differentiation from those that are commoditizing and apply a value based pricing approach

4. Eliminate or rationalize those products with commoditized margins – unless absolutely necessary as a portfolio item- from your company

5. Recalibrate the Pricing of those in the middle to a more competition or value based pricing strategy.

Ensure your analytics are confirmed and engage your sales force to share with them why your are evolving your pricing strategy from a list to a tool that better reflects the value customer will pay for and in the end what pays for their salaries and bonuses.