Conduct this systematic risk approach to steer clear or lessen Brexit threats your company is worried about.

Brexit has the full attention of many executives and companies world-wide. Many companies are prepared, but many more are not. Whichever way it goes - big dollars are at stake.

Whatever unfolds by October 31st - it pays to work through our three(3) step risk approach with your team now. The outputs will help you pinpoint, prevent and / or at least significantly minimize the impact Brexit may have on your business.

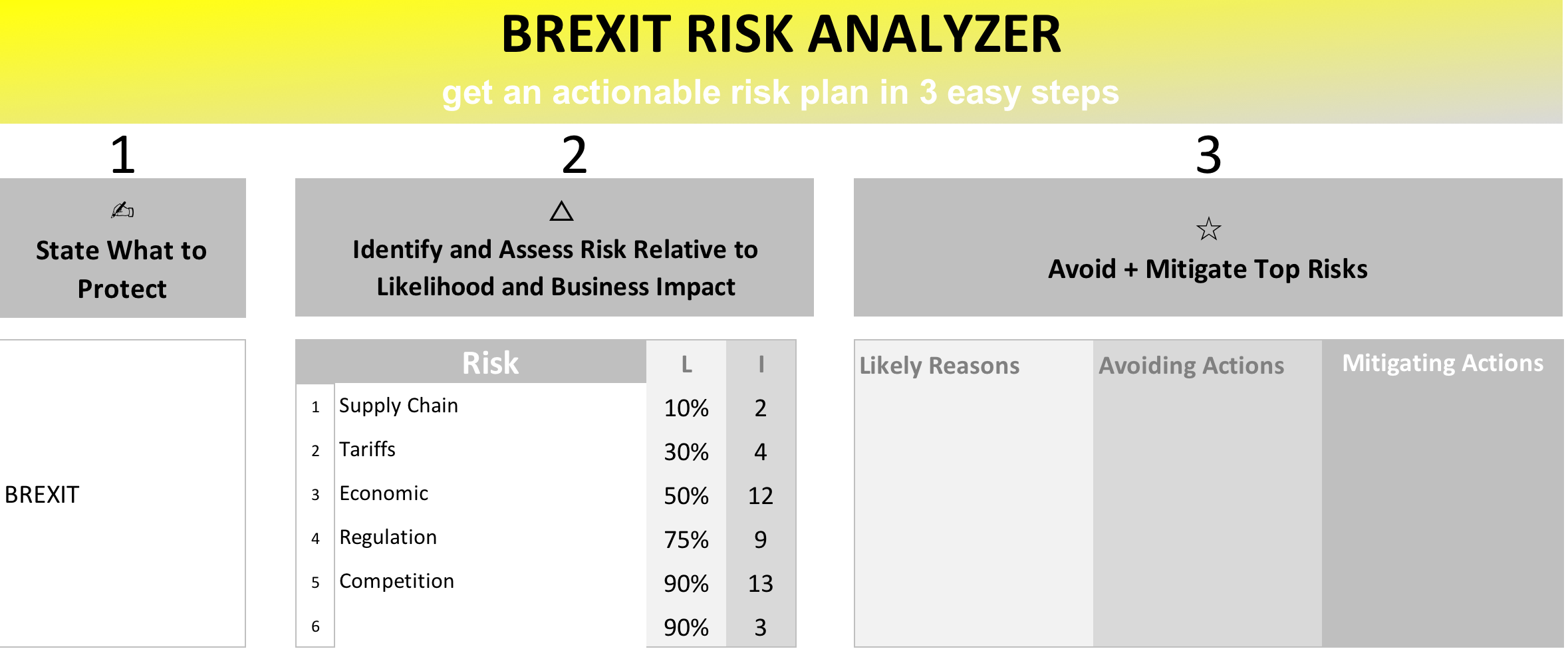

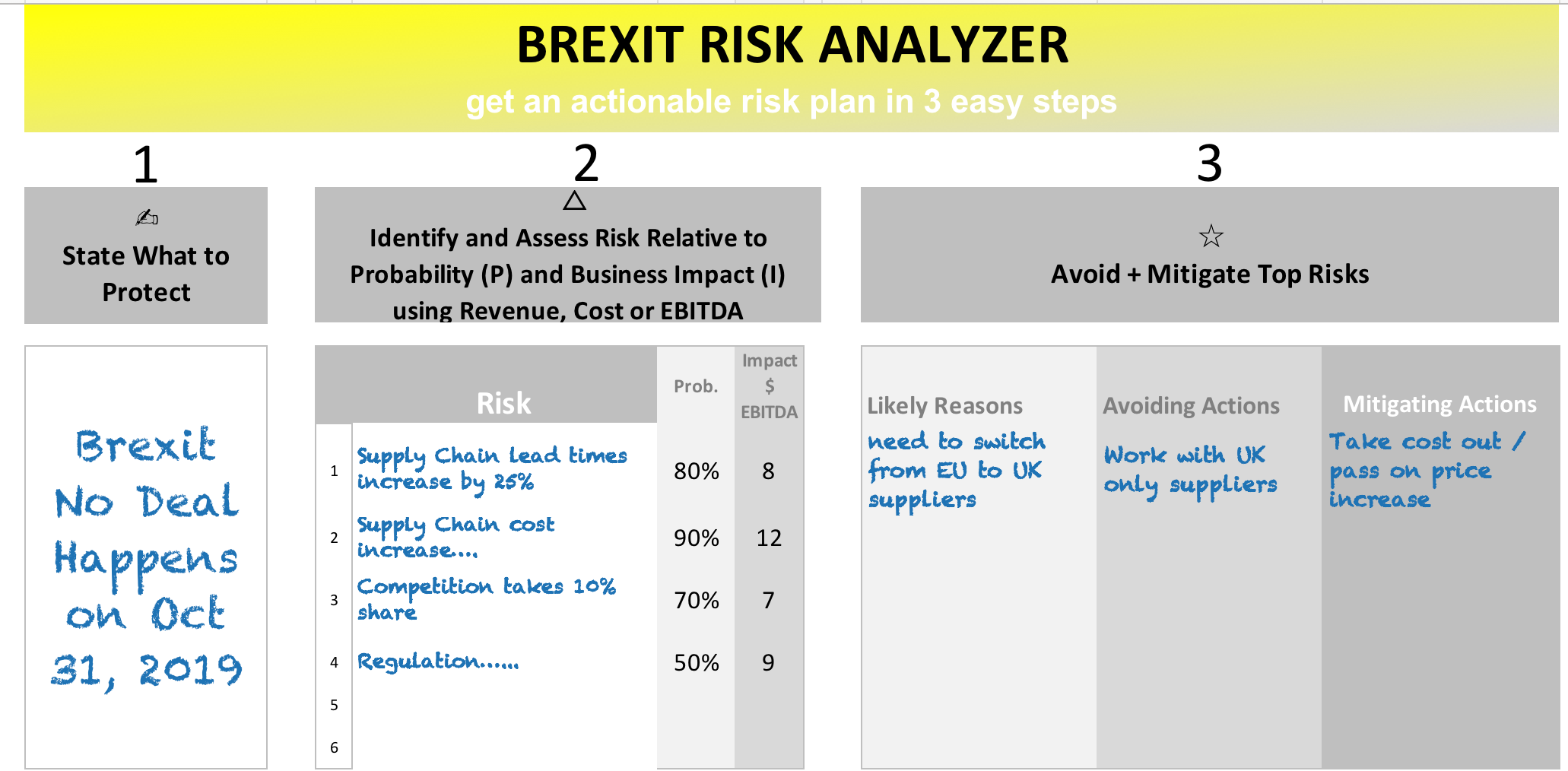

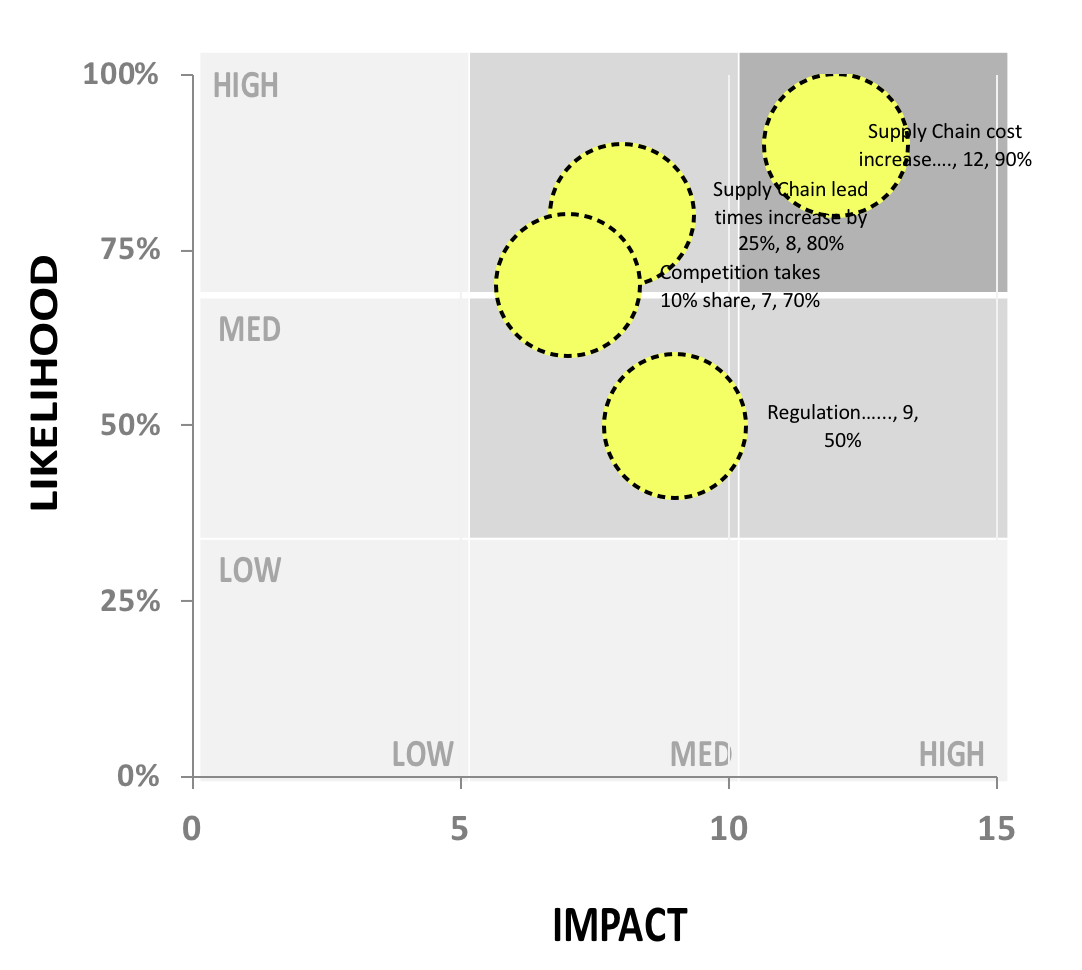

Risk in any sense is only about the Probability(P) of and the Impact(I) - if we can find the high Ps and the High I's ( and quantify it to Revenue, Cost or EBITDA $) - we can focus resources on the critical few Brexit risks to your business and have actions to prevent or mitigate risk.

The three steps are:

1. Don't Be A Victim

Whatever the size, industry or role your company, BU or subsidiary plays in the UK economy - don't get caught listening to the pundits saying what will or will not happen. Even in the best planned divorces, there's always wide cards. You need to make risks visible and specific.

Commit your leadership team to conduct a 1 page Brexit Risk Assessment to align and isolate the highest probability and highest impact risks because of Brexit. The "don't be a victim idea" turns the tides on inaction and squares up where preventative and continent actions should be placed. In addition, and critically so - it forces prioritization on key areas (products, services, customers) of your business.

2. Use 5 Categories to Get Specific About Types of Potential Problems

Use these five categories as a starting point to dimension out the risks. Separate and Specify.

| Brexit Risk Category |

| A. Supply Chain |

| B. Competition |

| C. Workforce |

| D. Customers / Tariffs |

| E. Regulation |

3. Conduct TDG's Brexit Risk Assessment with 5 Categories

Simply complete the BLUE areas with your own companies thinking. The more specific you are on potential risks - the easier to assign the risk and impact calibrations. ( The TEXT in blue provides an example of what your team needs to "fill out".)

Your team should work on putting a plan in place to execute the Avoiding actions now and the Mitigating actions AFTER October 31st - should it come to pass in this way. The full excel version of the Brexit Risk Analyzer - automatically creates the matrix below.

If you follow this critical thinking format - and keep it to one page - you will arrive at the crucial few and important preventative and contingent actions.

If the yardsticks move on Brexit - be it dates or scope .....get your team to conduct the 1 pager again.

If you want a working excel copy of this risk assessment format you can get it here. Rapid Risk Analyzer

Learn more about effective decision making...