Profitability in companies originate from well-defined niches and not volume commodities.

Consider the example of Porsche: while just 10% of the VW group’s revenues, it generates more than 30% of the entire group profits. In comparison, the premium Audi brand sold 1.5 Million vehicles to generate the same amount of net income.

In many companies, we find that management focus on volume growth as opposed to building well defendable competitive advantages. The discussion is on units, square feet, meters, pallets, pairs, packages and total market share yet rarely drills into profitability and where we make our money from.

In your company, take a dive into profitability and competitive advantage.

Some questions to ask include:

“Where do we win the highest percentage of our RFQs?”

“Where is our discounting and rebating from list price the lowest?”

“Where do our customers accept to wait for a back ordered item without canceling?”

“Which customers send us orders without a bidding or negotiation process. Why?”

“Where is our brand affinity the highest? What are we really known to be the best at? Who tells us we are the best, and what is there reason for saying and thinking this?”

This leads to a discussion on innovation. Returning to the Porsche example, Porsche expects their sales will Double in the next five years due to a boom in electric vehicles.

In comparison to many of the luxury marquee competitors of Porsche, the Porsche investment and development cycle on electric vehicles has been exceptional.

The new all electric model Taycan, with a retail price between $150,100 and $241,500 USD has already sold out all production until 2021.

The other car brands are now attempting to play catch up as they missed this innovation necessity.

The board at VW Group competitor BMW faced this headline in August from financial reporting around the world: “BMW CEO to quit after company falls behind on electric vehicles”

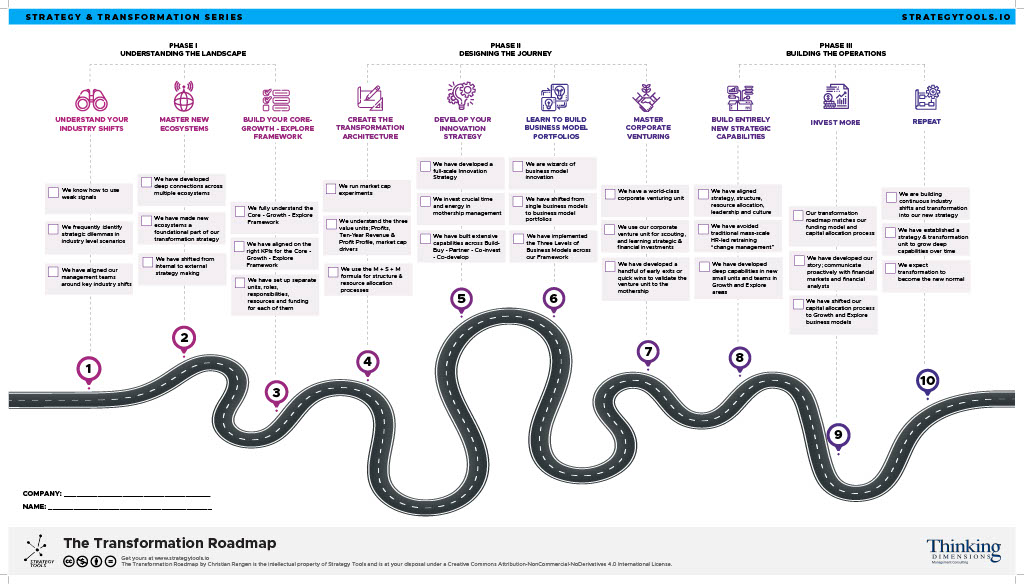

This underscores the importance of your Strategy and looking towards the future. What are the competitive advantages and capabilities you need to invest in for long-term sustainability and relevance? The answer is not volume.

Where do your profits come from?

Scott Newton is a Managing Partner at Thinking Dimensions specialized in Strategy and M&A.